Staying apprised of the regulatory/compliance shifts in trade is integral to all businesses in the logistics, supply chain, importing, and exporting space. As such, we’ll be providing an overview of changes in trade compliance — on a global scale.

As the past few months have made for a rocky road for many industries and many governing bodies have moved quickly to adapt their processes and requirements, to help ease the burden. The following summary is pulled from an extensive report put forth by Baker Mackenzie, a law firm that covers a global scope — self-described as “diverse, industry savvy, global citizens.”

The International Trade Compliance Update, authored by International Trade Lawyer, Stuart P. Seidel, covers import and customs requirements, export controls and sanctions, various remedies, World Trade Organization updates, and anti-corruption.

Here are some US-related highlights:

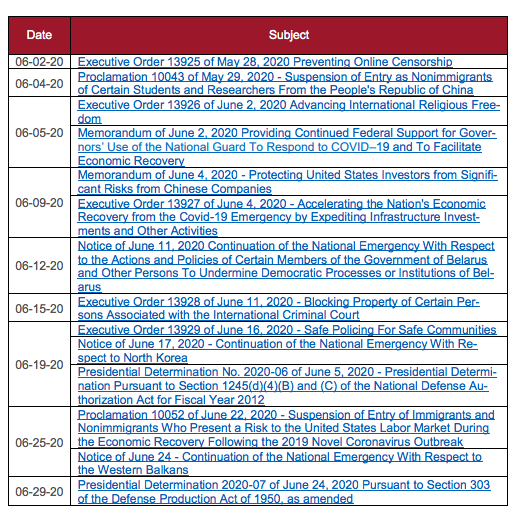

The following table represents a summary of documents signed by President Trump in June 2020.

Another North America-specific change in FTAs has been the enactment of USCMA/CUSMA/T-MEC, also known as the updated “NAFTA”. We previously covered what this means for importers and encourage you to read these articles for more information:

USMCA: New Trade Center For Private Sector Support

6 Main Differences Between USMCA and NAFTA

No review on Sec. 232 — the US Supreme court has denied a petition for review filed by the American Institute for International Steel. This petition would challenge the Administration’s ability to determine tariffs under sec. 232. As of now, there has been no reason provided for the denial.

As Baker Mackenzie puts it: “a hallmark of the Trump Administration trade policy is imposing tariffs.” Securing tariff exclusions is key for many companies’ survival in the supply chain industry. The administration has now earned a reputation for abruptly withdrawing critical exclusions.

However, last month, the US Court of International Trade stated that federal agencies must provide notice and comment periods as well as a “reasoned decision” before it can apply duties to previously excluded goods.

Below is a summary of all changes made in North America in the past month:

United States: Presidential documents, Chinese human rights violations, International Criminal Court sanctions, pandemic border restrictions, Hong Kong status, Supreme declines to review 232 tariffs, USMCA high wage components and labor committee, Mexico government procurement, USITC delivers MTB petition report, 232 and 301 updates, exclusions and CBP guidance, steel monitoring, US-Italy and US-Colombia cultural property agreement, USMCA regulations and implementation instructions, COAC virtual meeting, User Fee Advisory committee, broker district fees, proposed modernized broker regulations, “Lever rule” applications, withhold release orders, revocations/modifications of CBP rulings, CSMS messages, FTZ orders, State updates Cuba Restricted list, Syrian sanctions, ITAR suspensions, modifications for COVID-19, Entity List and OFAC SDN notices, Huawei participation in standards development, Australia Group amendments, FTC and CPSC documents, AMS concludes pilot ACE/ITDS test, USDA documents, AD/CVD cases and scope rulings.

Canada: CUSMA (USMCA/T-MEC) regulations, miscellaneous regulations, trade sanctions (Taliban, CAR, DRCongo, Eritrea, DPRK [N. Korea], Somalia, S. Sudan, Sudan), D-Memos, Customs Notices, AD/CVD cases

Mexico: T-MEC (USMCA-CUSMA) decree, text and regulations issued, General Rules of Foreign Trade, FTA government procurement thresholds, AD/CVD cases

The report also includes global changes as well, so it might be an interesting read for importers (and other professionals in the trade industry) to look over. Just was undoubtedly an uneventful month and August looks to be shaping up to be a month-to-watch as well!

Partnering up with a reputable customs broker can help navigate all of these confusing changes — no matter the size of your imports. To learn what a customs broker can do for you, start a 0 commitment conversation here.