Most U.S. import errors aren’t intentional.

They happen because a product was classified incorrectly, a value changed after entry, or documentation wasn’t complete at the time of filing. What matters isn’t that an error occurred, it’s how and when you correct it.

Under U.S. Customs rules, importers have two primary tools to fix mistakes:

Post Summary Corrections (PSCs) and Protests.

They are not interchangeable. Using the wrong one, or missing the deadline for both, can permanently lock in higher duties, eliminate refund opportunities, and increase audit exposure.

This guide explains the difference between PSCs and Protests, when each applies, and how importers should decide which path to take.

Why Correcting Entries Properly Matters

Once goods are released, many importers assume the import is “done.” It isn’t.

Every U.S. import follows a defined lifecycle, from entry filing to review, and finally liquidation. Errors that aren’t corrected before liquidation often become legally final. Clearit explains this full process in its overview of the U.S. customs import lifecycle.

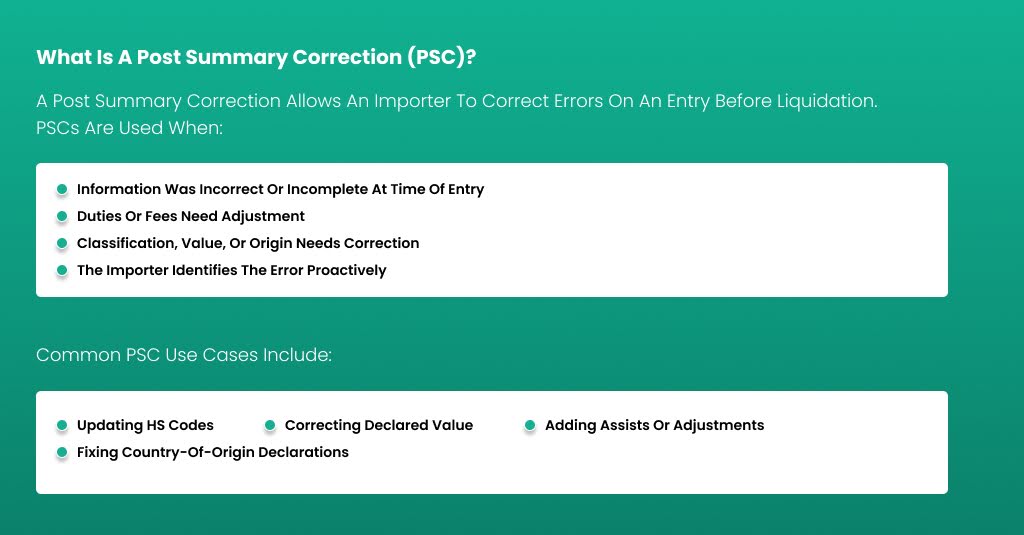

What Is a Post Summary Correction (PSC)?

Post Summary Corrections allow U.S. importers to fix entry errors before CBP finalizes liquidation.

A Post Summary Correction allows an importer to correct errors on an entry before liquidation.

PSCs are used when:

- Information was incorrect or incomplete at time of entry

• Duties or fees need adjustment

• Classification, value, or origin needs correction

• The importer identifies the error proactively

Common PSC use cases include:

- Updating HS codes

• Correcting declared value

• Adding assists or adjustments

• Fixing country-of-origin declarations

PSCs are corrective, not defensive. They assume CBP has not yet finalized the entry.

When a PSC Can Be Filed

Timing is everything.

A PSC can only be filed:

- After entry summary is filed

• Before CBP liquidates the entry

Once liquidation occurs, the PSC window closes.

This is why understanding liquidation timelines is critical. Clearit breaks down how liquidation works and why it matters here.

What Is a Protest?

A Protest is used after liquidation.

At this stage, CBP has already finalized duties, taxes, and fees. A protest is a formal legal challenge asking CBP to reconsider that decision.

Protests are typically filed when:

- CBP denies a refund

• CBP disagrees with classification or value

• A duty reassessment is issued

• A liquidation outcome is incorrect

Unlike PSCs, protests are not corrections, they are disputes.

Key Differences Between PSCs and Protests

| Aspect | Post Summary Correction | Protest |

|---|---|---|

| Timing | Before liquidation | After liquidation |

| Purpose | Correct errors | Challenge CBP decisions |

| Nature | Administrative correction | Legal appeal |

| Risk | Lower | Higher |

| Deadline | Before liquidation | Within 180 days of liquidation |

Why Many Importers Miss Their Best Chance to Fix Errors

The most common mistake importers make is waiting too long.

They assume:

- Brokers will fix it automatically

• Small errors won’t matter

• CBP will “figure it out”

But once an entry liquidates, options narrow dramatically.

This becomes especially costly when errors affect total landed cost, pricing, or margin calculations. Clearit explains why landed cost accuracy matters before and after import here.

PSCs, Protests, and Audit Risk

CBP doesn’t just look at individual entries, it looks at patterns.

Repeated errors, late corrections, or frequent protests can increase the likelihood of audits. Many importers first encounter audits after failing to manage corrections properly. Clearit’s guide to U.S. import audits explains what triggers them and how to prepare.

Using PSCs proactively often reduces audit exposure. Waiting for protests can do the opposite.

How Importer Responsibility Affects Corrections

Only the Importer of Record has the legal authority to file PSCs or Protests.

Confusion between the importer of record, consignee, and owner can delay or invalidate corrections. Clearit explains these roles in detail here.

If responsibility isn’t clear, corrections often don’t happen in time.

Post-De Minimis Enforcement Makes Timing Even More Critical

As CBP increases enforcement around Section 321 and informal imports, more shipments are moving into formal entry, where PSCs, protests, audits, and liquidation all apply.

This shift is explained in Clearit’s overview of post-de minimis compliance and beta shipments.

Importers who are new to formal entry often miss PSC deadlines simply because they’re unfamiliar with the process.

How Importers Should Decide: PSC or Protest?

Ask three questions:

Has the entry liquidated?

No → PSC may be available

Yes → Protest is the only option

Is this an error or a disagreement?

Error → PSC

Dispute → Protest

Is timing still on your side?

If not, options narrow fast

Early review and monitoring are the difference between correction and consequence.

Conclusion

PSCs and Protests serve different purposes, and using the wrong one at the wrong time can cost importers money they’ll never recover.

PSCs are about acting early. Protests are about responding after the fact.

Understanding the difference gives importers leverage, flexibility, and control in an increasingly enforcement-driven environment.

Because in U.S. customs, timing isn’t just important, it’s everything.

FAQs

Can I file a PSC after liquidation?

No. Once an entry liquidates, PSCs are no longer available.

Is a protest guaranteed to succeed?

No. Protests are reviewed by CBP and may be denied.

Do PSCs increase audit risk?

No, proactive corrections often reduce risk.

Who can file a PSC or Protest?

Only the Importer of Record.

How long do I have to file a protest?

Generally within 180 days of liquidation.