For many U.S. importers, the era of simple, low-value parcel imports is coming to an end. With the elimination of the $800 de minimis exemption, the import landscape has shifted dramatically, and your courier service alone is no longer enough to guarantee compliance.

Here’s why relying on a standard courier (think FedEx, UPS, or other cross-border parcel shippers) leaves critical risk gaps, and how digital customs brokerage must now play the lead role.

What Went Wrong with “Easy Button” Courier Shipping

For years, many importers treated courier shipping to the U.S. as “plug-and-play”: pack the parcel, attach a commercial invoice, and let the carrier handle the rest. When the de minimis threshold is applied, many shipments under that value are cleared with minimal review.

But this model breaks down in the post-threshold world. As of August 29, 2025, the U.S. will no longer allow shipments to automatically clear duty-free simply because they fall under the de minimis value.

What this means for courier-based shipments:

- Increased documentation requirements: HS codes, origin country, valuation details, partner-government-agency (PGA) compliance are now mandatory.

- Higher per-shipment processing costs: Each parcel may now trigger a full customs entry rather than a simplified declaration.

- Courier firms are optimized for speed and parcel flow, not for the complex tariff, origin, and valuation requirements now demanded.

In short: the “easy button” only worked when rules were light. That era is over.

The Compliance Gaps When Using Couriers Alone

Lack of Full Customs Entry Infrastructure

Couriers excel at last-mile delivery, but many do not provide full customs brokerage services: bond management, ACE filing, classification reviews, and audit-ready documentation. When every shipment becomes a formal entry, you need that infrastructure.

Weak Tariff & Valuation Oversight

Importers might rely on the courier’s customs line for clearance, but they often miss strategic opportunities like using the First Sale Rule to reduce duties. See our deeper dive here: First Sale Rule Explained: A Smart Way to Reduce Duties in 2025.

Inadequate Linkage to Refund & Audit Preparedness

With new refund opportunities under IEEPA and USMCA, accurate entry records and a complete audit trail are now essential. Simply basing clearance on courier documentation may leave you ineligible. (See IEEPA & USMCA refund opportunities for more.)

Limited Supplier & PGA Compliance Management

Couriers aren’t structured for supplier training, origin certification, or liaising with PGAs (FDA, EPA, etc.). Yet post-de minimis, these are every bit as important as the shipment itself.

Why Importers Now Need a Broker-Led Model

Formal Entry Mandatory

As explained in our article From Section 321 to Formal Entry: How U.S. Importers Can Thrive After De Minimis Ends, every parcel now must be treated as a formal entry. A full customs brokerage system is required.

Audit Risk Is Increasing

With the formation of the DOJ & DHS Trade Fraud Task Force, enforcement is intensifying. Relying solely on courier clearance exposes gaps in documentation that may trigger audits. See more in our overview: DOJ & DHS Trade Fraud Task Force: Import Audits.

Cost Savings Through Strategy, Not Just Speed

A modern broker-led solution doesn’t just clear goods, it optimizes value, classification, and compliance. That means lower duties, fewer surprises, and better long-term cost management.

Scalability & Visibility

When each parcel needs the same clearances previously reserved for large shipments, you need systems built for scale. Courier platforms lack visibility and analytics. A digital broker platform provides real-time dashboards, audit trails, and seamless integration across your entire supply chain.

What to Ask Before: Courier Only vs Broker + Courier

| Question | Courier Only | Broker + Courier |

|---|---|---|

| Bond arranged and maintained? | Often no | Yes |

| HS classification audited? | Minimal | Comprehensive |

| Use of the First Sale rule explored? | Rare | Possible |

| Audit-ready documentation storage? | Low | High |

| PGA screening/origin review? | Basic | Standard |

| Post-entry amendments/refunds handled? | Rare | Supported (see our Quick-Start Guide: Stress-Free Importing) |

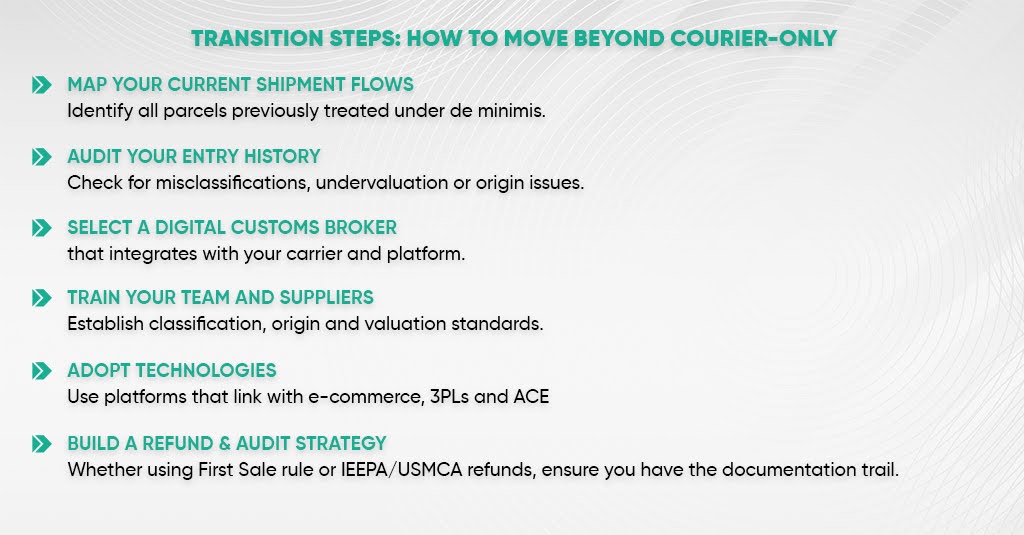

Transition Steps: How to Move Beyond Courier-Only

- Map your current shipment flows: Identify all parcels previously treated under de minimis.

- Audit your entry history: Check for misclassifications, undervaluation, or origin issues.

- Select a digital customs broker that integrates with your carrier and platform.

- Train your team and suppliers: Establish classification, origin, and valuation standards.

- Adopt technologies: Use platforms that link with e-commerce, 3PL,s and ACE.

- Build a refund & audit strategy: Whether using the First Sale rule or IEEPA/USMCA refunds, ensure you have the documentation trail.

Conclusion

The era of “send a parcel, hope it clears” is over. In today’s import environment, compliance is strategic, not optional. When every shipment must be treated as a formal entry, you cannot rely solely on courier services built for speed. You need full customs expertise, integration, and audit-ready systems.

Don’t wait for a misclassification, detention, or audit to force your hand.

Elevate your clearance process. Partner with a customs broker that treats every parcel like an enterprise-grade entry, and make sure your shipments arrive compliantly, on time, and cost-effectively.

Explore how to get started here: Clearit’s Quick-Start Guide to Stress-Free Importing.

FAQs

Q1: Isn’t my courier still clearing customs?

In many cases, yes, but they may only perform basic clearance. They often cannot handle full entry filings, audit trails, or advanced valuation strategies.

Q2: Will using a broker slow down my shipment?

Not if properly integrated. A well-managed broker model cuts delays by avoiding re-work or detention. Speed comes from compliance, not shortcuts.

Q3: Does this only apply to small shipments?

No. With the end of the de minimis threshold, even very small parcels now require full entry. The risk and compliance burden is across all shipment sizes.

Q4: What about cost? Isn’t a broker more expensive than using a courier service?

Up-front per-shipment fees may be higher, but when you factor in avoided duties, audit risk, and delays, the total landed cost is often lower with a broker-led model.

Q5: What’s the first step to upgrade my model?

Review your current carrier contracts, ask what customs services they provide, then identify broker options aligned with your volume and risk profile.