Most importers only see two moments in the import journey: when a shipment leaves the supplier and when it arrives at their warehouse.

Everything in between feels like a black box.

But in 2025, that “black box” is where most risks actually live. With the end of the De Minimis era, increased enforcement, and new digital data requirements, understanding the true lifecycle of a U.S. import is no longer optional. Every missed detail, incorrect HS code, or vague invoice can trigger delays, penalties, or audits.

Here’s what really happens behind the scenes at U.S. Customs, and why importers need structured, scalable compliance to keep products moving.

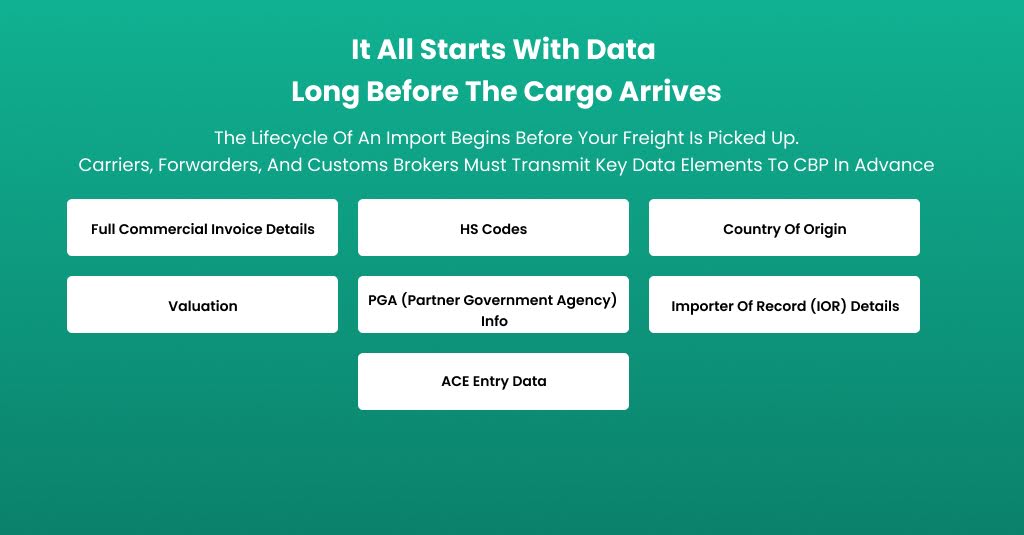

It All Starts With Data — Long Before the Cargo Arrives

Key import data elements—commercial invoices, HS codes, origin, valuation, PGA documents, IOR details, and ACE entry data—must be sent to CBP before cargo arrives to prevent delays and holds.

The lifecycle of an import begins before your freight is picked up.

Brokers, carriers, and forwarders must submit key data sets to CBP in advance, including:

- Commercial invoice details

- HS codes

- Country of origin

- Declared value

- PGA (Partner Government Agency) data

- Importer of Record (IOR) information

- ACE entry data

In the post–De Minimis environment, importers can no longer rely on couriers to correct or cover documentation errors. If you’re still adjusting your operations, see From Section 321 to Formal Entry.

Why this stage matters:

If any data is wrong, mismatched, or incomplete, CBP can flag the shipment before it even reaches the border.

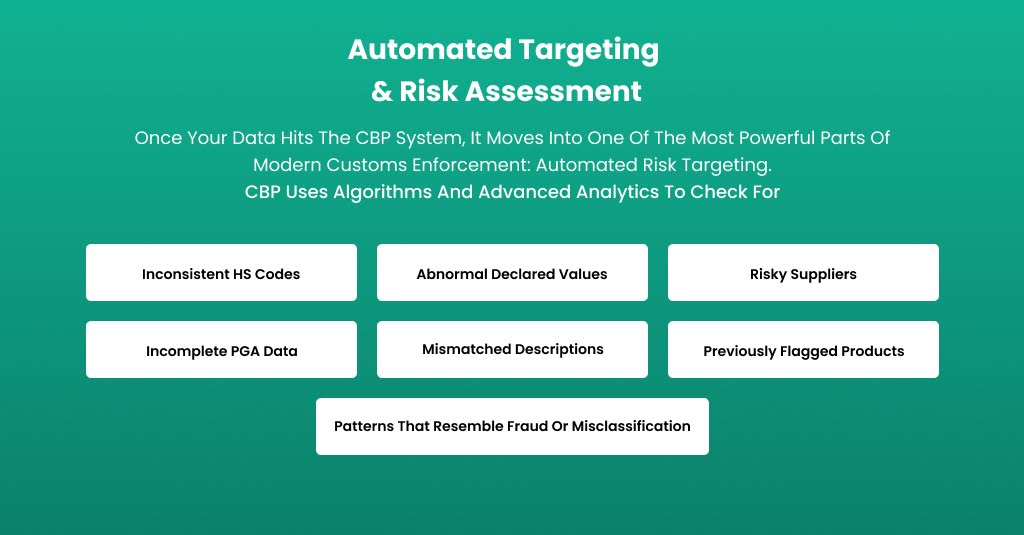

Automated Risk Targeting & Digital Screening

Once your data hits the CBP system, it moves into one of the most powerful parts of modern customs enforcement: automated risk targeting.

CBP uses algorithms and advanced analytics to check for:

- Inconsistent HS codes

- Abnormally low declared values

- High-risk suppliers

- Missing or incomplete PGA details

- Vague or generic product descriptions

- Previously flagged SKUs

- Fraud-like patterns

This is where most CBP holds begin — not at the border, but inside the risk-scoring system.

The DOJ/DHS Trade Fraud Task Force uses these same datasets to initiate audits.

Learn more here: DOJ/DHS Trade Fraud Task Force: Import Audits Explained

Manifest Review & Match Against Entry Data

CBP then cross-references:

- The carrier’s manifest

- The ACE entry submitted by your broker

- Your supplier’s invoice

- PGA filings

Any mismatch — even minor — can trigger:

- Document review

- Valuation questions

- Intensive examination (I.E)

- Entry rejections

- Origin verification

Example:

If the invoice says “homeware accessories” but the HS code corresponds to “steel kitchenware,” the system flags the discrepancy instantly.

Poor supplier documentation is the #1 reason for mismatches, especially for brands scaling volume. Consider updating templates using Clearit USA’s Quick Start Guide.

Partner Government Agency (PGA) Clearance

Products may require clearance from agencies such as:

- FDA

- USDA

- CPSC

- EPA

- FCC

- DOT

If the PGA data is wrong or missing:

- Entries are placed on hold

- Releases are delayed

- Goods may be refused

- Carriers may restrict future freight

- Warehouse fees accumulate

This stage affects importers shifting from DTC parcel shipping to full-scale importing, where PGA rules now fully apply. Many products that previously moved under Section 321 now require full PGA compliance.

Physical Inspection (When Ordered)

Only a small portion of shipments undergo physical inspection, but the probability increases if:

- HS codes fluctuate

- Invoice descriptions are vague

- Declared values are unusually low

- Supplier paperwork is inconsistent

- You’ve made repeated entry corrections

Inspection methods include:

- X-ray scanning

- Container devanning

- Chemical testing (cosmetics)

- Textile testing (apparel)

- Electronics certification reviews

Inspections can still occur even if your shipments previously moved through couriers. That’s why more brands are moving to structured import models with bulk freight and clear documentation, as described in IEEPA + USMCA refund planning.

Duty Assessment & Valuation Review

At this point, CBP evaluates whether the declared value is correct.

This is where many importers get into trouble — especially those sourcing from Asia or using middlemen.

CBP regularly challenges values when:

- Invoices don’t align with payment records

- packaging or materials imply a higher value

- The importer has inconsistent valuations across SKUs

- Related-party transactions aren’t explained

- The declared value seems abnormally low for the category

This is also where the First Sale Rule becomes extremely valuable for compliant importers: First Sale Rule Explained: How to Lower Declared Value Legally

Release — Or Hold, Detain, or Request for Information

Based on all prior steps, the shipment moves into one of the following statuses:

Released – Everything matched

Released with documents pending – Post-release corrections needed

Hold – Waiting for documents or explanations

Detention – Cargo under review

Examination – Physical inspection required

Request for Information (CBP Form 28) – More documentation required

Notice of Action (CBP Form 29) – CBP intends to adjust your entry

Seizure – For serious compliance issues

This stage determines whether your supply chain runs smoothly or grinds to a halt.

For many importers, scaling means increasing scrutiny, which is why it helps to understand how CBP uses data, risk scoring, and audit triggers.

Post-Release Monitoring & Audit Exposure

Even after release, CBP continues monitoring:

- Classification consistency

- USMCA claims

- Valuation accuracy

- Refund claims (IEEPA, Section 301, USMCA 1520(d))

- Supplier patterns

- Declarations vs. historical data

Post-release reviews can trigger:

- Audits

- Penalties

- Demands for duties

- Recordkeeping checks

- Forced corrective actions

Importers with inconsistent documentation face the highest risk, especially under the DOJ/DHS task force.

Why Understanding the Import Lifecycle Matters More in 2025

The end of De Minimis has exposed weaknesses in many import processes:

- Inconsistent HS codes

- Unclear invoices

- Reliance on couriers

- Missing PGA data

- Poor documentation from suppliers

- Lack of formal internal compliance controls

Importers who scale without understanding the lifecycle of an import face:

- Shipping delays

- Penalties

- Lost customers

- Increased costs

- Audit exposure

Now more than ever, success requires visibility into each step of the customs process, not blind reliance on carriers or automated systems.

Final Thoughts: Transparency Is Your New Competitive Advantage

Understanding what happens behind the scenes at U.S. Customs gives you the ability to:

- Reduce delays

- Avoid penalties

- Prepare for audits

- Streamline documentation

- Improve cost forecasting

- Protect your supply chain

2025 is the year U.S. importers must shift from reactive to proactive compliance.

If you’re scaling beyond courier parcel importing, start by reviewing your operational workflow using Clearit USA’s Quick Start Guide to Stress-Free Importing.

The more you understand the lifecycle of an import, the more control you have over your supply chain.

FAQs

1. What part of the import lifecycle causes the most delays?

Data mismatches during automated risk review — especially HS code or valuation inconsistencies.

2. Do small shipments get less scrutiny?

Not anymore. Every shipment now requires full documentation.

3. Can couriers still handle compliance?

No. They no longer act as compliance shields in the post–De Minimis era.

4. When does CBP decide to inspect a shipment?

When data anomalies, supplier risks, or valuation concerns are detected.

5. How long does CBP keep monitoring entries after release?

Up to 5 years is the length of the recordkeeping requirement.