As global trade costs rise and the U.S. prepares to eliminate the $800 De Minimis threshold, importers are looking for every possible way to lower landed costs without cutting corners. One strategy that’s gaining new attention in 2025 is the First Sale Rule, a long-standing but often misunderstood customs valuation method that can legally reduce import duties on qualifying transactions.

For businesses importing through multi-tiered supply chains, mastering this rule could mean the difference between shrinking profit margins and staying competitive.

Here’s what the First Sale Rule is, how it works, and how U.S. importers can take advantage of it.

What Is the First Sale Rule?

The First Sale Rule (FSR) allows U.S. importers to calculate customs duties based on the price paid in the first sale of goods intended for export to the United States, instead of the higher resale price paid by a middleman or distributor.

In simple terms, this means you can declare the manufacturer’s selling price as the dutiable value, rather than the markup added by intermediaries in your supply chain.

Example:

- A factory in Vietnam sells a product to a trading company in Hong Kong for $50.

- That trading company then sells it to your U.S. business for $75.

- Under the First Sale Rule, you can declare the $50 factory price, saving duties on the $25 markup.

Although the First Sale Rule has existed for decades, recent tariff changes and the end of De Minimis exemptions have made it one of the most effective cost-saving strategies for importers in 2025.

Why the First Sale Rule Matters More Than Ever in 2025

With the upcoming elimination of Section 321’s $800 De Minimis threshold, even low-value shipments will require formal customs entry and duty assessment. That means higher administrative costs and, potentially, millions in new tariff expenses across industries.

Importers who learn to apply the First Sale Rule correctly can offset these costs by reducing the taxable value of each import.

In today’s global supply chains, especially those involving multiple sales before goods reach the U.S., the opportunity for savings is substantial.

To understand the broader impact of these trade policy shifts, check out U.S. Import Tariffs 2025: A Complete Guide to Business Impact.

How the First Sale Rule Works

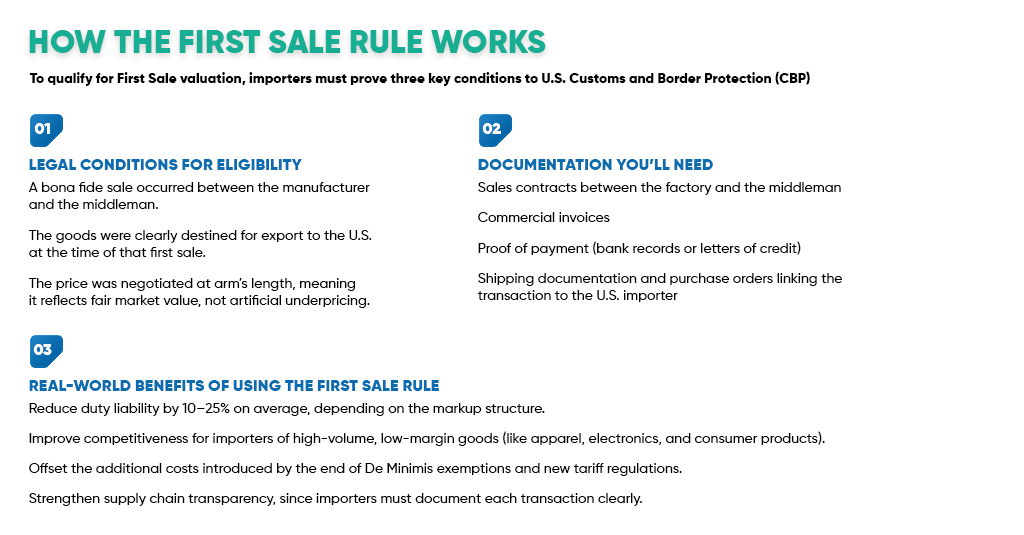

To qualify for First Sale valuation, importers must prove three key conditions to U.S. Customs and Border Protection (CBP):

Legal Conditions for Eligibility

- A bona fide sale occurred between the manufacturer and the middleman.

- The goods were clearly destined for export to the U.S. at the time of that first sale.

- The price was negotiated at arm’s length, meaning it reflects fair market value, not artificial underpricing.

Documentation You’ll Need

Documentation is everything. Importers must maintain detailed proof of the transaction chain, including:

- Sales contracts between the factory and the middleman

- Commercial invoices

- Proof of payment (bank records or letters of credit)

- Shipping documentation and purchase orders linking the transaction to the U.S. importer

CBP may audit these documents, so maintaining accurate records is critical for compliance.

Real-World Benefits of Using the First Sale Rule

When implemented properly, the First Sale Rule can:

- Reduce duty liability by 10–25% on average, depending on the markup structure.

- Improve competitiveness for importers of high-volume, low-margin goods (like apparel, electronics, and consumer products).

- Offset the additional costs introduced by the end of De Minimis exemptions and new tariff regulations.

- Strengthen supply chain transparency, since importers must document each transaction clearly.

These savings can be especially meaningful for small and mid-sized importers trying to stay competitive after Section 321 elimination forces formal entry for every shipment.

Key Compliance Considerations

The First Sale Rule isn’t a loophole, it’s a legitimate but strictly regulated valuation method. To use it successfully:

- Ensure all transaction documentation is traceable and verifiable.

- Confirm the goods are clearly earmarked for U.S. export from the start.

- Conduct periodic internal audits or partner with a customs broker familiar with FSR filings.

- Avoid “price padding” or inconsistent invoices between supplier tiers.

If CBP determines that documentation doesn’t support the declared first-sale price, the importer may be liable for back duties, penalties, and interest.

Understanding the broader customs environment can also help. Review Tariff Pass-Through: How Duties Impact Inflation for U.S. Importers to see how duty valuation ties into your pricing and compliance strategy.

Common Pitfalls Importers Should Avoid

Many businesses miss out on First Sale savings, or worse, apply it incorrectly, due to avoidable errors such as:

- Missing proof of payment between factory and intermediary

- Lack of export intent documentation

- Relying on verbal pricing agreements

- Inconsistent shipping and invoicing details

- Applying FSR to transactions that involve non-U.S. final destinations

Proper coordination between purchasing, logistics, and customs teams is essential. Importers should also review their supplier relationships to identify where First Sale pricing structures are feasible.

How to Implement the First Sale Rule Successfully

- Map Your Supply Chain: Identify all parties involved in each import transaction.

- Evaluate Qualification: Determine if goods are destined for the U.S. from the first sale.

- Document Every Step: Keep detailed records linking manufacturer to importer.

- Work With a Broker: A digital customs broker can file entries using the First Sale value, manage audits, and ensure ACE filing accuracy.

- Monitor Tariff Changes: The U.S. trade landscape continues to evolve. Staying current ensures ongoing compliance and savings.

For example, our article U.S.–China Tariffs Explained: What Importers Need to Know in 2025 outlines how certain duties may interact with valuation methods like FSR.

Conclusion

In 2025, as formal customs entry becomes the norm for every import, the First Sale Rule stands out as one of the smartest, most compliant ways to reduce duty costs.

By documenting your supply chain, coordinating with suppliers, and leveraging expert customs support, you can turn complex regulations into a competitive advantage.

Start preparing now, review your import documentation, identify eligible First Sale opportunities. You can Partner with Clearitusa.com to simplify First Sale Rule filings and stay compliant with every U.S. customs change in 2025.

FAQs

Q1: Does the First Sale Rule apply to all products?

It applies to most goods imported into the U.S., provided the importer can document each sale in the supply chain and meet CBP’s requirements.

Q2: Can small businesses use the First Sale Rule?

Yes. SMBs importing through trading companies or buying agents can benefit significantly, especially as duties rise post-De Minimis.

Q3: Is the First Sale Rule the same as transfer pricing?

No. FSR relates to customs valuation for import duties, while transfer pricing applies to income tax reporting. They must align, but they serve different functions.

Q4: How much can I realistically save?

Savings vary, but importers commonly see 10–25% duty reductions, depending on product type and supply chain complexity.

Q5: How often do I need to prove eligibility?

Documentation must be available for every import entry where the First Sale Rule is used. CBP may audit records at any time.