In the wake of shifting trade policies, especially IEEPA tariffs and USMCA 1520(d) claims, many U.S. importers are finding themselves eligible for refunds on duties they’ve already paid.

However, claiming these refunds isn’t always straightforward. The process often hinges on two key tools within U.S. Customs and Border Protection’s (CBP) systems: the ACE Protest Module and FTA Reconciliation entries.

Proper use of these tools can mean the difference between recovering significant duty costs and leaving money on the table. This guide breaks down what every U.S. importer needs to know to stay compliant and maximize their refund opportunities.

Understanding the ACE Protest Module

The Automated Commercial Environment (ACE) is CBP’s platform for managing trade compliance and customs processes.

The ACE Protest Module is where importers (or their customs brokers) can challenge duties assessed on imports, including IEEPA-related tariffs, or request refunds when duties were overpaid.

A successful protest can result in the return of significant funds, but strict CBP deadlines apply. Most protests must be filed within 180 days of liquidation, meaning businesses can’t afford to delay.

What Are FTA Reconciliation Entries?

FTA (Free Trade Agreement) Reconciliation entries allow importers to defer providing certain details—such as final documentation proving USMCA eligibility—until after entry.

For example, a shipment may enter the U.S. under standard duty rates because the certificate of origin wasn’t yet available. Once the documentation is ready, the importer can file a reconciliation entry to claim the correct USMCA preference and request a refund on duties paid.

It’s important to note, however, that reconciliation entries cannot be used to change product classifications or declared values, only to finalize details originally flagged for later submission.

Refund Opportunities Under IEEPA & USMCA

Recent CBP clarifications have opened up refund opportunities for goods affected by IEEPA tariffs and USMCA claims.

For instance, a U.S. importer sourcing raw materials from Canada may have initially paid duties, but could later qualify for a refund if the goods meet USMCA §1520(d) rules or fall under IEEPA tariff refund provisions.

Timing matters: CBP has emphasized that only entries made after March 7, 2025 (when updated refund eligibility rules took effect) may qualify. Importers should carefully review their historical entries to identify potential refund opportunities.

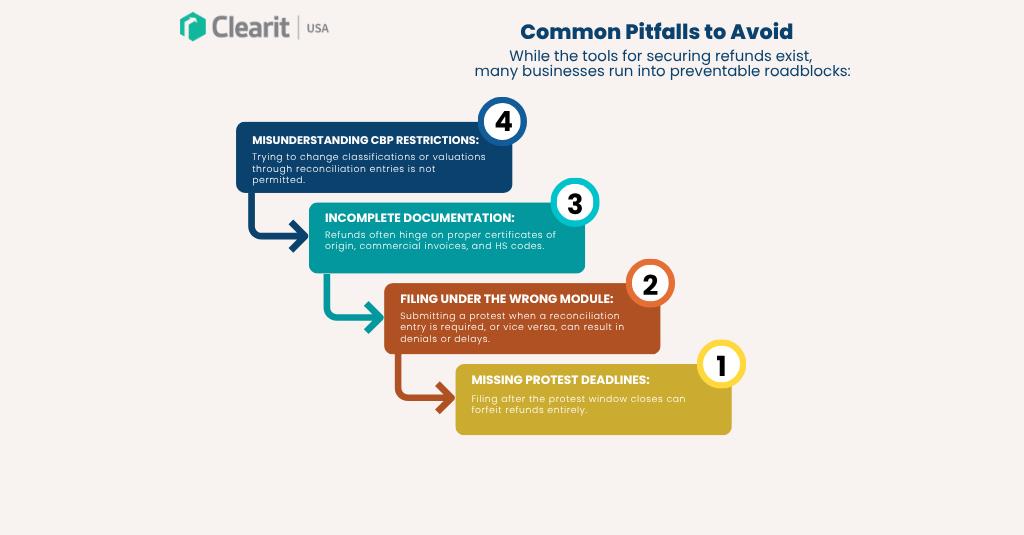

Common Pitfalls to Avoid

Common mistakes to avoid in CBP refund filings through the ACE Protest and FTA Reconciliation process, including missing deadlines, wrong submissions, and incomplete import documentation.

While the tools for securing refunds exist, many businesses run into preventable roadblocks:

- Missing Protest Deadlines: Filing after the protest window closes can forfeit refunds entirely.

- Filing Under the Wrong Module: Submitting a protest when a reconciliation entry is required, or vice versa, can result in denials or delays.

- Incomplete Documentation: Refunds often hinge on proper certificates of origin, commercial invoices, and HS codes.

- Misunderstanding CBP Restrictions: Trying to change classifications or valuations through reconciliation entries is not permitted.

Best Practices for Compliance and Refund Success

To maximize refund success while staying CBP-compliant:

- File protests promptly through the ACE system to avoid missing deadlines.

- Collaborate closely with your customs broker to ensure accurate data in reconciliation entries.

- Conduct a historical audit of past imports to uncover overlooked refund opportunities.

- Stay informed about tariff and compliance changes, see our guides on U.S. Import Tariffs 2025: A Complete Guide to Business Impact and U.S and China Tariffs Explained: What Importers Need to Know in 2025.

- Understand how duties influence costs with Tariff Pass-Through: How Duties Impact Inflation for U.S. Importers and how to avoid Hidden Costs of Importing for Small Businesses.

How Clearit USA Helps

At Clearit USA, we specialize in navigating complex CBP processes to help importers reclaim funds they’re entitled to. We support businesses by:

- Preparing and submitting protests via ACE on your behalf.

- Managing FTA Reconciliation entries to recover duties tied to USMCA claims.

- Aligning all supporting documents, certificates of origin, HS codes, and invoices, to avoid CBP rejections.

- Advising SMBs and larger importers alike on refund eligibility under IEEPA tariffs.

For instance, one SMB client was able to recover thousands in overpaid duties on Canadian textiles after Clearit identified eligibility for a USMCA 1520(d) refund and filed the necessary reconciliation entry.

FAQs

- What’s the deadline for filing a protest in ACE?

Most protests must be filed within 180 days of liquidation. Missing this window means forfeiting the refund. - Are all IEEPA-related refunds eligible for protests?

Not necessarily. Eligibility depends on the date of entry and CBP’s rules for that specific tariff action. - Can small businesses file protests or reconciliation entries themselves?

Yes, but it’s often complex. Most SMBs benefit from working with a customs broker to avoid mistakes. - What’s the difference between protests and post-entry amendments?

A protest challenges CBP’s original decision or duties assessed. A post-entry amendment corrects mistakes made by the importer before liquidation.

Don’t miss out on refunds your business deserves. Partner with Clearit USA to handle protests, reconciliation entries, and documentation seamlessly, ensuring compliance and maximizing your refund opportunities.