Art and collectibles move through U.S. borders every day, from gallery acquisitions and auction purchases to private collections and museum loans. While many importers assume artwork clears customs easily, the reality is more nuanced. Valuation rules, documentation requirements, and classification accuracy all play a major role in determining whether a shipment moves smoothly or gets flagged for review.

In 2025, enforcement has become more data-driven, and high-value shipments are attracting greater scrutiny from U.S. Customs and Border Protection (CBP). Whether you’re a first-time buyer importing a sculpture or a business scaling art imports, understanding duties and valuation is critical to avoiding delays, reassessments, and penalties.

This guide explains what importers need to know before shipping art into the United States—and how to build a compliant process from the start.

Why Art Imports Receive Special Attention

CBP closely monitors art imports due to valuation risks, private sales, and non-standard pricing structures.

Unlike standardized consumer goods, artwork often has subjective value, making it more difficult for CBP to verify declared prices. This creates risk from a compliance standpoint.

Shipments are more likely to be reviewed when they involve:

- High declared values

- One-of-a-kind pieces

- Private-party transactions

- Rapid resale after import

- Inconsistent invoice structures

CBP increasingly relies on analytics to detect anomalies in valuation patterns. Heightened enforcement across industries means even legitimate shipments can be selected for review.

To understand how audit activity is expanding, see this blog.

Are Duties Charged on Imported Artwork?

Many original works of art qualify for duty-free treatment under the Harmonized Tariff Schedule (HTS). However, this depends heavily on how the item is classified.

Typically duty-free categories include:

- Original paintings and drawings

- Hand-made sculptures

- Limited-edition prints (meeting specific criteria)

- Items that may not qualify:

- Mass-produced reproductions

- Decorative art objects

- Framed prints produced commercially

- Certain collectible merchandise

- Even when duty is zero, importers must still account for:

- Merchandise Processing Fee (MPF)

- Harbor Maintenance Fee (for ocean freight)

- Brokerage costs

- Freight and insurance

Duty-free does not mean compliance-free.

Classification Determines Everything

Correct HTS classification is one of the most important steps in importing art.

For example:

- An original oil painting is often duty-free.

- A printed reproduction may be dutiable.

- A decorative antique could fall under an entirely different tariff heading.

- Misclassification can trigger:

- Duty reassessments

- Customs inquiries

- Entry corrections

- Financial penalties

As shipments scale, classification consistency becomes even more important, especially for importers transitioning from low-value parcels to formal entries.

Learn what that transition involves here.

Valuation: The Area Where Importers Make the Most Mistakes

CBP requires importers to declare the true transaction value—the actual price paid or payable for the goods.

Art transactions, however, don’t always follow conventional pricing structures.

Common Valuation Scenarios

Gallery Purchases:

Usually straightforward if supported by a commercial invoice.

Auction Sales:

The hammer price alone may not reflect total value if buyer’s premiums apply.

Private Sales:

These can raise questions if documentation is weak.

Related-Party Transactions:

CBP may evaluate whether pricing reflects fair market value.

Can the First Sale Rule Apply to Art?

In some supply chains, the First Sale Rule allows importers to declare the price from the earliest qualifying transaction rather than a marked-up resale value. While this is more common in manufacturing environments, understanding valuation strategies is essential for any high-value importer.

Explore how the rule works here. Proper application requires strong documentation and audit-ready records.

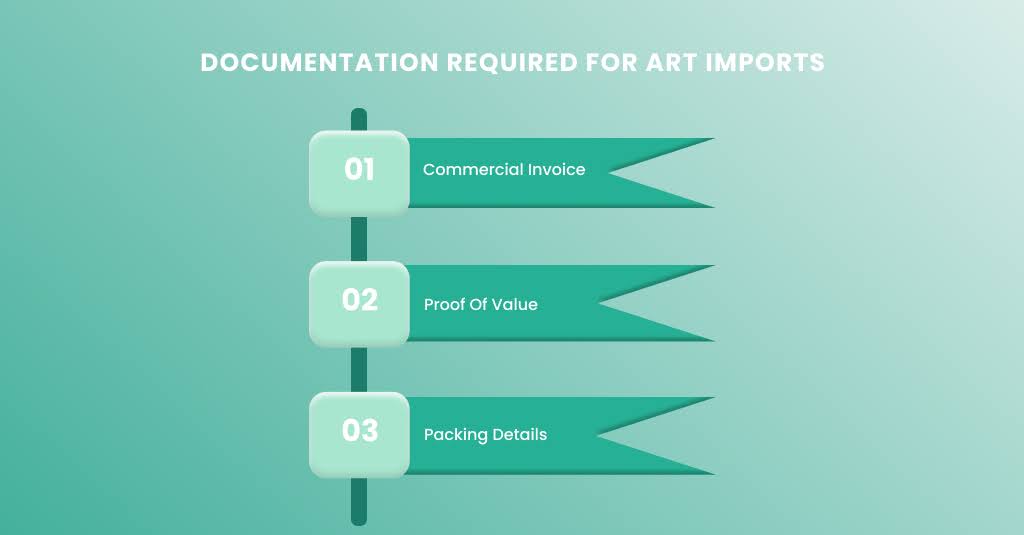

Documentation Required for Art Imports

Complete and accurate documentation is critical when importing artwork and collectibles into the United States.

Thorough paperwork is the best protection against delays.

Commercial Invoice

Your invoice should clearly state:

- Artist name

- Title of the work

- Medium (oil, watercolor, bronze, etc.)

- Year created

- Purchase price

- Country of origin

- Avoid vague descriptions like “art piece” or “collectible.”

Proof of Value

Depending on the transaction, CBP may expect:

- Auction house invoices

- Bills of sale

- Gallery contracts

- Appraisals (in some cases)

Packing Details

High-value items often undergo closer inspection, making accurate packing lists essential.

Country of Origin Documentation

The origin is typically where the artwork was created, not where it was sold.

Incorrect origin declarations are a common audit trigger.

Refund opportunities may exist when origin and tariff treatments are properly documented.

Import Audits and High-Value Shipments

Art shipments are not immune to audits. In fact, unusual pricing structures can make them more visible.

CBP reviews often uncover:

- Undervalued imports

- Misclassified reproductions

- Missing documentation

- Incorrect origin reporting

Building a structured compliance workflow early is the safest approach. For a practical foundation, read Clearit USA’s guide to stress-free importing.

Common Mistakes That Delay Art Shipments

Importers frequently run into problems due to:

- Declaring insured value instead of transaction value

- Using incomplete invoices

- Failing to separate freight and artwork costs

- Misclassifying reproductions as originals

- Omitting buyer’s premiums from auction purchases

- Providing inconsistent documentation

These errors can lead to inspections, holds, and post-entry corrections.

Best Practices for Importing Art and Collectibles

Following best practices helps reduce CBP inspections, delays, and valuation disputes for art and collectible imports.

1. Be Precise With Descriptions

Specificity helps CBP classify goods quickly.

2. Document the Transaction Clearly

Maintain contracts, invoices, and payment records.

3. Validate Classification Before Shipping

Do not rely on assumptions, even experienced buyers get this wrong.

4. Separate Costs Properly

Freight, insurance, and commissions should be documented correctly.

5. Prepare for Scrutiny on High-Value Entries

The higher the value, the greater the likelihood of review.

6. Maintain Long-Term Records

CBP can examine imports years after entry.

Conclusion

Importing art and collectibles into the United States is less about logistics and more about precision, accurate valuation, proper classification, and complete documentation.

As customs enforcement becomes more sophisticated, importers who invest in compliance early will avoid costly surprises later.

Whether you’re importing a single masterpiece or managing recurring acquisitions, preparation is the key to keeping shipments moving.

Want to build an import process that stands up to CBP scrutiny? Start here.

FAQs

Is original artwork really duty-free in the U.S.?

Often yes, but only when classified correctly.

Will CBP question the value of expensive artwork?

High-value shipments are more likely to be reviewed.

Do private purchases face more scrutiny than gallery sales?

They can, especially if documentation is limited.

Can CBP reassess value after release?

Yes. Importers may owe additional duties if discrepancies are found.

Are collectibles treated the same as fine art?

Not always. Many collectibles fall under different tariff categories.

How far back can CBP audit imports?

Typically up to five years.

Do duty-free goods still require full documentation?

Absolutely, duty-free status does not reduce compliance obligations.