For years, U.S. e-commerce brands and marketplace sellers thrived on direct-to-consumer (DTC) parcel shipping. The model worked because Section 321 exemptions, low-value thresholds, and courier-driven clearances allowed products to ship directly from overseas suppliers to American customers with almost no friction.

But in 2025, this model will become structurally unsustainable.

With the elimination of the $800 De Minimis threshold, steep increases in courier fees, stricter import audits, and heightened CBP enforcement, importers relying on DTC parcels now face:

- Higher per-unit logistics costs

- Frequent compliance failures

- Delivery delays and returns

- Red flags for misclassification or undervaluation

- Significant audit exposure

The new reality? Importers must evolve.

This article breaks down how fast-growing U.S. sellers can transition from DTC parcel shipping to full-scale, structured importing, complete with consolidation, formal entries, warehousing, and compliance systems built for longevity.

Related reading: From Section 321 to Formal Entry: How U.S. Importers Can Thrive After De Minimis Ends

Why DTC Shipping No Longer Scales in 2025

Direct-to-consumer importing made sense under previous conditions:

- Section 321 eliminated duties

- Couriers handled most compliance work

- Order volumes were modest

- CBP oversight was lighter

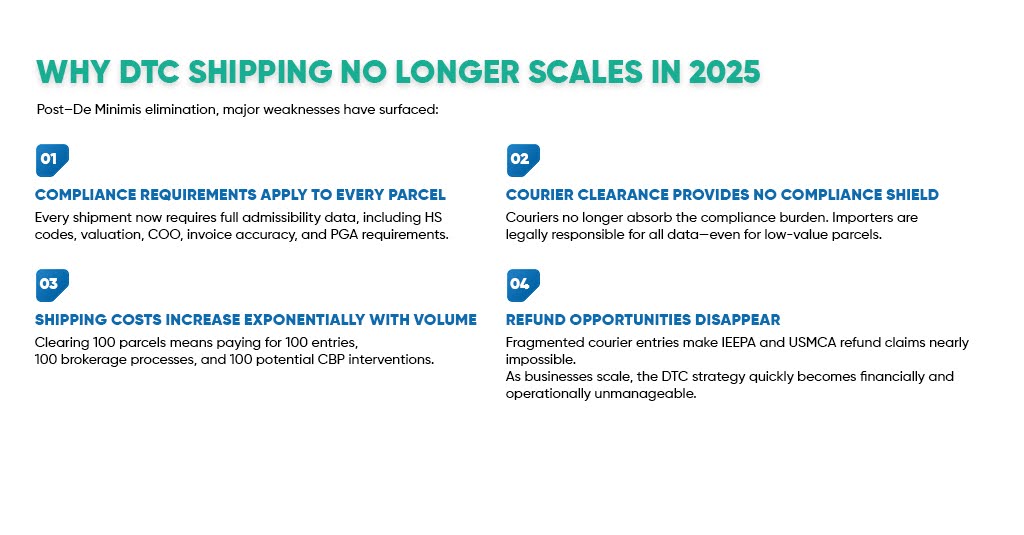

Post–De Minimis elimination, major weaknesses have surfaced:

1. Compliance Requirements Apply to Every Parcel

Every shipment now requires full admissibility data, including HS codes, valuation, COO, invoice accuracy, and PGA requirements.

2. Courier Clearance Provides No Compliance Shield

Couriers no longer absorb the compliance burden. Importers are legally responsible for all data—even for low-value parcels.

3. Shipping Costs Increase Exponentially With Volume

Clearing 100 parcels means paying for 100 entries, 100 brokerage processes, and 100 potential CBP interventions.

4. Refund Opportunities Disappear

Fragmented courier entries make IEEPA and USMCA refund claims nearly impossible.

As businesses scale, the DTC strategy quickly becomes financially and operationally unmanageable.

The Evolution of Importing: When DTC Shipping Stops Making Sense

Importers typically reach a breaking point as soon as:

- Order volumes exceed 50–100 parcels per day

- Duty and clearance costs start exceeding product margins

- Shipments are repeatedly held for missing or inconsistent data

- Suppliers use different invoices, classifications, or documentation formats

- CBP red flags appear for undervaluation or misclassification

- Refund opportunities are lost due to fragmented entry records

At this stage, continuing with DTC parcel shipping becomes a liability, both operational and legal.

What Full-Scale Importing Actually Looks Like

Scaling import operations means building structure, predictability, and compliance into the supply chain.

A full-scale model includes:

1. Consolidated International Shipments

Products are shipped in bulk, weekly or monthly, to a U.S. distribution point.

2. A Single Formal Entry Per Bulk Shipment

One customs declaration replaces hundreds of courier entries.

3. Warehousing or 3PL Fulfillment

Goods enter once, then move domestically more quickly and efficiently.

4. Standardized Tariff Classifications

Every SKU gets a consistent, compliant HS code.

5. Accurate, U.S.-Ready Commercial Documentation

Clear descriptions, valuations, Incoterms, and country-of-origin statements.

6. Defined Importer of Record (IOR) Strategy

Clarity on who is legally responsible for the entry.

7. ACE Filing Through a Licensed Customs Broker

Real-time visibility, traceability, and proper entry filings.

For SMBs scaling up, this is the turning point between struggling with compliance chaos and achieving operational maturity.

Need a foundational guide? Check out: Clearit’s Quick Start Guide to Stress-Free Importing

The Operational Advantages of Scaling Up

Shifting from DTC parcels to full-scale importing creates immediate, measurable benefits.

1. Lower Landed Costs

Bulk importing reduces:

- International freight per unit

- Repeat courier/brokerage fees

- Clearance costs per shipment

Full entries also unlock First Sale Rule eligibility, enabling legally lower declarations when structured correctly.

2. Stronger Compliance Infrastructure

Bulk imports create:

- Cleaner documentation

- Consistent classification

- Fewer audit triggers

- Easier post-summary corrections

3. Faster, More Predictable Delivery

Shipping once to the U.S. and distributing domestically:

- Shortens delivery windows

- Reduces border dependencies

- Eliminates courier clearance bottlenecks

4. More Refund Opportunities

A structured import model enables:

- IEEPA refunds

- USMCA claims

- PSC-based duty recoveries

More on this: IEEPA + USMCA Refund Opportunities

How to Make the Transition Smoothly (Step-by-Step)

Here’s a practical roadmap for brands ready to scale:

Step 1: Audit Your Import Flow

Evaluate:

- SKUs and classifications

- Supplier documentation quality

- Invoice consistency

- Current shipping lanes

- PGA requirements

Step 2: Build a Consolidation Strategy

Determine:

- Weekly, biweekly, or monthly bulk shipments

- Destination warehouse or 3PL (Amazon, Walmart, DTC)

- Domestic distribution channels

Step 3: Prepare U.S.-Ready Documentation

Standardize:

- HS codes

- Valuation statements

- Country-of-origin data

- Commercial invoices

Step 4: Choose a Customs Brokerage Model

A digital broker integrated with ACE filing offers:

- Real-time entry updates

- Duty estimation

- Error detection before submission

Step 5: Strengthen Supply Chain Controls

Mitigation strategies include:

- Educating suppliers

- Enforcing invoice quality

- Pre-shipment compliance checks

- Unified SKU classification database

Essential reading: DOJ & DHS Trade Fraud Task Force: What It Means for Import Audits

Compliance Considerations Importers Can’t Ignore

Scaling import operations introduces new responsibilities:

1. Proper Classification

Especially for high-risk categories, such as electronics, apparel, chemicals, and consumer goods.

2. Correct Valuation

Including eligibility for the First Sale Rule and ensuring appropriate transaction value declarations.

3. Origin Documentation

Accurate certificates, supplier statements, and origin disclosures.

4. Recordkeeping

Importers must maintain entry records for five years.

5. Post-Entry Adjustments

PSC filings for correcting errors before they become audit liabilities.

6. ACE Data Consistency

Misaligned data across entries is a top audit trigger. With enforcement rising sharply, compliance can’t be an afterthought.

Conclusion

The end of De Minimis represents a fundamental shift in U.S. importing. What once worked for small DTC brands no longer scales in a compliance-heavy environment. Moving to full-scale importing—complete with consolidation, formal entries, structured documentation, and domestic fulfillment—delivers:

- Lower costs

- Faster fulfillment

- Better audit protection

- Clean, consistent data

- Eligibility for refund opportunities

Importers who adapt now will have a powerful competitive advantage in the post–De Minimis landscape.

Ready to scale your imports with confidence? Start building a full-scale import model today and take the complexity out of compliance.

FAQs

Do I still need a customs broker if I import small quantities?

Yes. Post-De Minimis, all imports require compliant documentation and formal entries.

Can I still use couriers after scaling?

Yes, but only for domestic distribution, not cross-border importing.

What’s the difference between DTC parcels and full-scale importing?

DTC = individual parcels + courier clearance. Scale importing = bulk shipment + formal entry + domestic fulfillment.

Is full-scale importing only for large enterprises?

No, SMBs, Amazon sellers, and growing DTC brands benefit the most.

How long does transitioning take?

Typically, 2–6 weeks, depending on complexity and supplier readiness.

Do I need a warehouse in the U.S.?

Most scaling importers use a 3PL, fulfillment center, or bonded warehouse.