The world of U.S. importing is changing fast. With the elimination of the $800 De Minimis threshold, the launch of the DOJ & DHS Trade Fraud Task Force, and increased scrutiny over tariff classifications and country-of-origin claims, compliance has become the new competitive edge.

For importers scaling their operations in 2025 and beyond, success will depend on one thing — building a future-proof compliance model that scales with your business, not against it.

Why Compliance Is Now a Growth Strategy

Until recently, many small and mid-sized importers considered customs compliance a back-office burden. However, with trade enforcement tightening, compliance is now a frontline defense against costly penalties, shipment delays, and lost margins.

As CBP and the Department of Justice ramp up trade fraud investigations, even routine importers now face audits for misclassification, undervaluation, and false origin claims.

Learn more about this new enforcement landscape in Audits Ahead: What the DOJ & DHS Trade Fraud Task Force Means for Your Imports.

A scalable compliance model is no longer optional; it’s the foundation of reliable, cost-efficient importing.

The End of De Minimis: A Turning Point for U.S. Importers

The upcoming expiration of the Section 321/$800 de minimis exemption marks a fundamental shift in how U.S. importers handle low-value shipments. Now, every package entering the country, regardless of value, must go through formal customs clearance.

That means more documentation, stricter data accuracy requirements, and a greater risk of errors if your systems aren’t built for volume.

To understand how to transition from courier-driven imports to structured compliance, read From Section 321 to Formal Entry: How U.S. Importers Can Thrive After De Minimis Ends.

What “Future-Proof” Compliance Looks Like

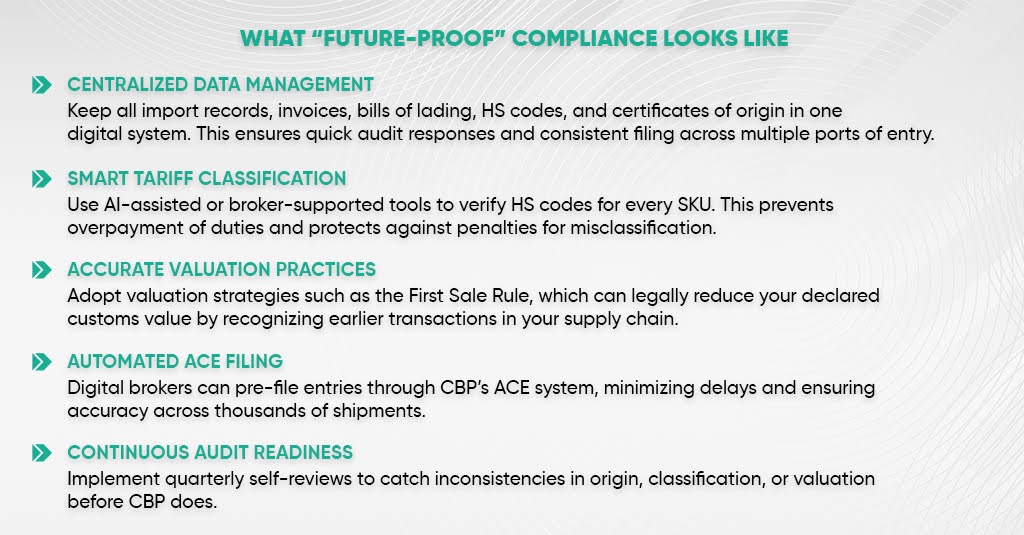

To thrive at scale, importers need compliance frameworks that can adapt, not collapse, under increasing regulation and shipment volume. A future-proof model should include:

Centralized Data Management

Keep all import records, invoices, bills of lading, HS codes, and certificates of origin in one digital system. This ensures quick audit responses and consistent filing across multiple ports of entry.

Smart Tariff Classification

Use AI-assisted or broker-supported tools to verify HS codes for every SKU. This prevents overpayment of duties and protects against penalties for misclassification.

Accurate Valuation Practices

Adopt valuation strategies such as the First Sale Rule, which legally reduces declared customs value by recognizing earlier, arm’s-length transactions in your supply chain.

Explore how this strategy works in The First Sale Rule Explained: A Smart Way to Reduce Duties in 2025.

Automated ACE Filing

Digital brokers can pre-file entries through CBP’s ACE system, minimizing delays and ensuring accuracy across thousands of shipments.

Continuous Audit Readiness

Implement quarterly self-reviews to catch inconsistencies in origin, classification, or valuation before CBP does.

Common Compliance Gaps Importers Overlook

Even experienced importers can make costly mistakes as they scale operations.

Here are some of the most common pitfalls CBP auditors are flagging in 2025:

| Compliance Gap | Impact |

|---|---|

| Inconsistent HS codes across shipments | Misclassification penalties and refund denials |

| Missing country-of-origin documentation | USMCA benefits lost |

| Using outdated duty rates or tariff data | Overpaying or triggering refund claims |

| Relying on courier-based clearance | Lack of traceable records and compliance exposure |

| Ignoring internal audit schedules | Increased risk of DOJ/DHS investigation |

Don’t miss IEEPA + USMCA: How to Spot Refund Opportunities in Your Canadian/Mexico Imports, a key resource on identifying duty recovery opportunities while staying compliant.

Scaling Imports the Smart Way

As you expand sourcing or distribution, compliance management must evolve alongside logistics.

Here’s how forward-thinking importers are staying ahead:

- Investing in digital customs systems that integrate with e-commerce platforms and ERPs.

- Partnering with specialized brokers who manage filings across multiple product lines.

- Using data analytics to identify high-duty items for potential tariff engineering.

- Automating compliance checklists to ensure every shipment is documentation-ready.

For a simple step-by-step framework, download Clearit’s Quick Start Guide to Stress-Free Importing.

Conclusion

As global trade becomes more regulated and transparent, importers who build compliance-first operations will win, not just survive. A future-proof compliance model means fewer delays, fewer fines, and more predictable costs — giving importers a competitive edge in a regulated market. It’s time to make your compliance as scalable as your imports.

Don’t wait for a CBP notice to rethink your process.

Start modernizing your import compliance today with Clearit’s Quick Start Guide to Stress-Free Importing, your roadmap to smarter, safer, and more efficient trade in 2025 and beyond.

FAQs

Q1: What’s the biggest compliance challenge for importers in 2025?

Adjusting to the formal entry process after De Minimis ends, especially for businesses handling thousands of small-value imports.

Q2: How often should importers conduct internal audits?

At least quarterly, or after any major sourcing change, to ensure HS codes and valuation methods remain accurate.

Q3: Can brokers help with refund claims?

Yes. Licensed brokers can file and manage USMCA and IEEPA refund claims on your behalf.

Q4: What’s the advantage of digital brokerage systems?

They automate filing, prevent data errors, and provide real-time visibility into compliance and duty payments.

Q5: Will DOJ/DHS enforcement affect small businesses too?

Yes, the Trade Fraud Task Force explicitly targets SMB importers using inconsistent or incomplete documentation.