The U.S. import landscape is entering a new era of enforcement.

With the launch of the DOJ & DHS Trade Fraud Task Force, Importers of all sizes — not just multinational corporations — should prepare for heightened federal scrutiny.

This task force, led by the Department of Justice (DOJ) and the Department of Homeland Security (DHS), is tasked with investigating fraud across trade and customs operations.

Its arrival marks a clear signal: the era of lax compliance is over.

The New Era of Enforcement

In early 2025, the DOJ and DHS announced a coordinated initiative to tackle customs fraud, duty evasion, and misclassification schemes affecting billions in lost revenue. The Trade Fraud Task Force unites several agencies, including CBP, ICE, and the Department of Commerce, to share data, coordinate audits, and launch targeted investigations.

Why Compliance Matters Now

The creation of the Trade Fraud Task Force signals more than just another federal initiative — it represents a shift toward accountability across every level of the import chain. With agencies like CBP, DOJ, and DHS now sharing real-time data, importers can no longer rely on outdated documentation practices or assume their shipments go unnoticed. Every import declaration, HS code, and valuation entry is now traceable and comparable across multiple databases. For businesses, this means compliance is no longer just a safeguard — it’s a competitive advantage. Importers that demonstrate transparency and accuracy will face fewer disruptions, while those with weak compliance systems risk being the first targets of the task force’s audits.

Why now?

Because the U.S. trade system has shifted dramatically the $800 De Minimis threshold (the minimum value exempt from formal customs entry).

As explained in No More $800 Free Pass: What the Elimination of the U.S. De Minimis Threshold Means for Importers in 2025, every shipment entering the U.S. now requires full customs clearance. This increase in data has exposed gaps in classification accuracy and valuation — precisely the issues this task force was created to address.

What the Trade Fraud Task Force Does

The Trade Fraud Task Force focuses on investigating:

- Undervaluation schemes, where importers declare artificially low prices to reduce duties.

- Misclassification of goods, particularly in industries with complex supply chains such as electronics, apparel, and furniture.

- False country-of-origin declarations meant to sidestep trade tariffs or anti-dumping duties.

- Falsified documentation used to manipulate trade data or evade taxes.

By combining the enforcement power of CBP with the investigative reach of the DOJ and ICE, the task force will use data analytics, whistleblower tips, and inter-agency audits to identify irregular trade patterns and take enforcement action.

Why Importers Should Pay Attention

In previous years, enforcement primarily targeted large corporations. That’s changing.

The DOJ has confirmed that the task force will also examine routine importers and SMBs, particularly those relying on automated filing systems, third-party couriers, or bulk low-value import models.

Through data-sharing agreements, CBP and DOJ can now cross-reference import records with supplier invoices, payment data, and tariff filings, meaning inconsistencies are easier to spot than ever.

For businesses, the consequences can be serious:

- Costly fines and penalties

- Shipment holds or seizure

- Loss of trade privileges or trusted trader status

- Criminal investigations in severe cases

Many of these issues stem not from deliberate fraud, but from poor documentation or misunderstanding of customs rules, as outlined in Hidden Costs of Importing for Small Businesses.

Key Audit Triggers Under the New Task Force

Here are the red flags that may draw the task force’s attention to your shipments:

- Repeated undervaluation on invoices compared to supplier records.

- Misclassified HS codes that lower duty rates.

- Missing, vague, or inconsistent country-of-origin declarations.

- Inconsistent commercial invoices between exporter and importer.

- Excessive use of Section 321 (De Minimis) entries before its elimination in August 2025.

The lesson is clear: accuracy is non-negotiable.

Customs agencies now use AI-driven tools to detect even subtle inconsistencies across import and trade data.

For a deeper look at how tariffs affect business pricing and compliance, review Tariff Pass-Through: How Duties Impact Inflation for U.S. Importers.

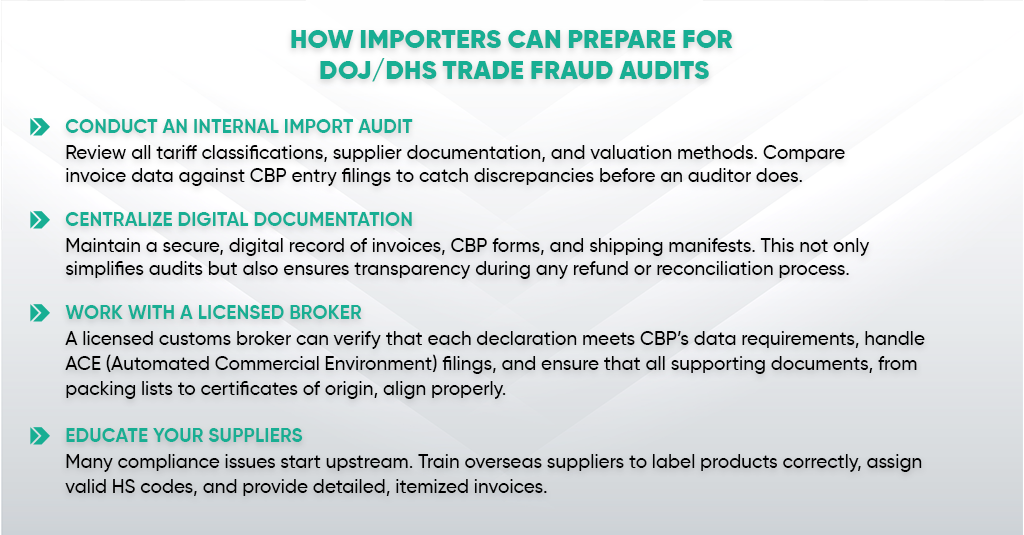

How Importers Can Prepare for DOJ/DHS Trade Fraud Audits

Preparation is the key to avoiding disruption. Importers should take a proactive, audit-ready approach by focusing on four critical areas:

1. Conduct an Internal Import Audit

Review all tariff classifications, supplier documentation, and valuation methods. Compare invoice data against CBP entry filings to catch discrepancies before an auditor does.

2. Centralize Digital Documentation

Maintain a secure, digital record of invoices, CBP forms, and shipping manifests. This not only simplifies audits but also ensures transparency during any refund or reconciliation process.

3. Work With a Licensed Broker

A licensed customs broker can verify that each declaration meets CBP’s data requirements, handle ACE (Automated Commercial Environment) filings, and ensure that all supporting documents, from packing lists to certificates of origin, align properly.

4. Educate Your Suppliers

Many compliance issues start upstream. Train overseas suppliers to label products correctly, assign valid HS codes, and provide detailed, itemized invoices.

For more insight into tariffs, duty rates, and how to plan for new cost structures, see U.S. Import Tariffs 2025: A Complete Guide to Business Impact.

Common Mistakes to Avoid

Even well-intentioned importers can stumble when enforcement tightens. Avoid these common pitfalls:

- Assuming only large companies get audited. The new task force is specifically targeting SMBs that rely heavily on automation or couriers.

- Delegating compliance entirely to third-party carriers. Couriers like UPS or FedEx handle logistics, not trade law.

- Failing to reconcile IEEPA or USMCA refund claims with accurate entry data.

- Ignoring inconsistencies between supplier invoices, shipment values, and CBP filings.

Top 5 Audit Red Flags Checklist

- Missing HS codes or country of origin

- Valuation discrepancies exceeding 10%

- Frequent “amended” entry filings

- Repetitive errors in ACE submissions

- Supplier invoices with unclear product descriptions

Conclusion

The launch of the DOJ & DHS Trade Fraud Task Force marks the most aggressive import enforcement effort in recent years.

For importers, this shift is not just about avoiding fines, it’s about building resilient, transparent supply chains that can withstand regulatory scrutiny.

By auditing your import processes now, centralizing data, and enforcing supplier accountability, you can stay compliant and competitive, even in an era of increased enforcement.

Audit season is here, don’t wait for a notice. Review your import entries, verify your suppliers, and build compliance confidence before enforcement knocks.

FAQs

Q1: What industries will the DOJ & DHS task force focus on first?

High-duty sectors like apparel, electronics, steel, and furniture are top priorities, but any business with import irregularities may be audited.

Q2: What happens if I’m contacted for an audit?

Respond immediately, provide documentation, and coordinate with your customs broker. Timely cooperation often prevents escalation.

Q3: How far back can audits go?

CBP can review import entries up to five years from the date of importation.

Q4: Can small businesses be audited too?

Yes, in fact, SMBs are among the most at-risk due to less formal compliance programs.

Q5: How can I reduce my risk?

Maintain consistent classification, retain complete documentation, and verify supplier records before shipment.