Recent clarifications by U.S. Customs and Border Protection (CBP) have opened the door for many importers to claim refunds on duties paid under the International Emergency Economic Powers Act (IEEPA).

For companies sourcing goods from Canada or Mexico, this is a crucial moment to review past entries and uncover potential savings, especially under the USMCA’s Section 1520(d) refund provisions.

In this post, we’ll explain how IEEPA tariffs interact with USMCA rules, which shipments may qualify for refunds, and the practical steps importers can take to maximize recovery.

1. Why Refund Opportunities Are Emerging Now

Over the past few years, U.S. importers have been hit with a patchwork of IEEPA-driven duties on products otherwise eligible for preferential treatment under USMCA.

CBP recently clarified that goods of Canadian or Mexican origin, if assessed IEEPA duties in error, may now qualify for refunds—provided importers file the correct type of claim within applicable timelines.

This change is particularly relevant for:

- U.S. businesses that regularly import automotive parts, industrial goods, or consumer products from Canada or Mexico

- SMBs and e-commerce sellers that often lack dedicated compliance teams

- Importers who entered goods during tariff-transition windows (such as the March 4–6 IEEPA tariff gap) that affected refund eligibility dates

Understanding these developments is critical for any importer looking to avoid the hidden costs of importing for small businesses and recover overpaid duties.

2. Understanding IEEPA Tariffs in a USMCA Context

IEEPA tariffs are emergency trade measures imposed under the International Emergency Economic Powers Act (IEEPA), typically by presidential authority to address foreign trade or national security concerns.

Under the USMCA, qualifying goods from Canada and Mexico typically enjoy duty-free treatment. However, IEEPA tariffs can temporarily override that status unless CBP determines the goods are exempt.

When CBP issues clarifications on refund eligibility, importers can often recover these duties by filing a protest or a USMCA 1520(d) refund claim through the Automated Commercial Environment (ACE).

Failing to act quickly could mean missing refund deadlines and losing potential savings.

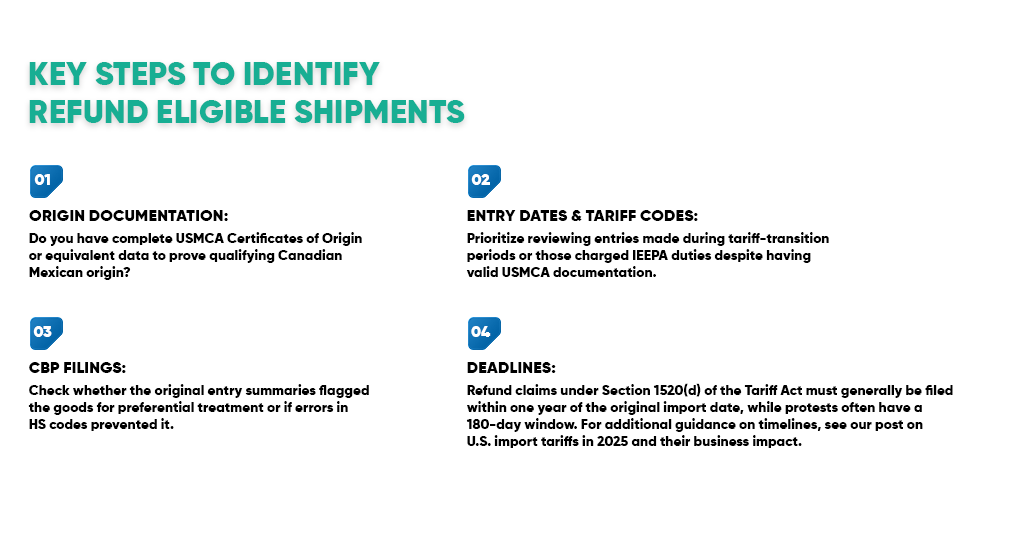

3. Key Steps to Identify Refund-Eligible Shipments

Spotting refund opportunities starts with a detailed review of your import data. Consider:

- Origin Documentation:

Do you have complete USMCA Certificates of Origin or equivalent data to prove qualifying Canadian/Mexican origin? - Entry Dates & Tariff Codes:

Prioritize reviewing entries made during tariff-transition periods or those charged IEEPA duties despite having valid USMCA documentation. - CBP Filings:

Check whether the original entry summaries flagged the goods for preferential treatment or if errors in HS codes prevented it. - Deadlines:

Refund claims under Section 1520(d) of the Tariff Act must generally be filed within one year of the original import date, while protests often have a 180-day window. For additional guidance on timelines, see our post on U.S. import tariffs in 2025 and their business impact.

4. Documentation to Get Right

Successful refund claims hinge on proper paperwork.

Importers should be ready to provide:

- Complete and accurate USMCA Certificates of Origin for all qualifying goods

- Commercial invoices and packing lists that match entry declarations

- Correct HS classifications and evidence of Canadian/Mexican production

- Supporting records (bills of lading, supplier affidavits, etc.) to back up the origin claim

Aligning these documents early prevents delays and reduces the risk of refund denial due to missing or inconsistent data, a common contributor to tariff pass-through costs that impact U.S. importers’ pricing.

5. Common Pitfalls That Lead to Lost Refunds

Even when shipments qualify, many importers miss out due to avoidable errors, including:

- Missing protest or 1520(d) deadlines

- Submitting incomplete ACE reconciliation entries that don’t tie to original entries

- Overlooking transition-period shipments, such as those falling into the March 4–6 IEEPA tariff gap

- Failing to audit older entries, assuming they’re ineligible when they may not be

Proactive auditing can help prevent these mistakes and improve cash-flow recovery.

6. Practical Tips to Maximize Recovery

To make the most of these opportunities:

- Audit historical imports for Canadian- and Mexican-origin goods affected by IEEPA duties

- Coordinate closely with suppliers to ensure timely origin documentation

- Use ACE reports and entry-line data to track eligible shipments quickly

- Maintain a central record-keeping system so future claims can be supported without scrambling for paperwork

- Keep an eye on shifting trade policies, like U.S.–China tariff changes explained for importers in 2025, to avoid future overpayments.

7. Conclusion

IEEPA tariff refunds offer a valuable opportunity for U.S. importers to recover overpaid duties—but only if they act promptly and maintain accurate records.

A disciplined approach to auditing past entries and filing timely claims helps ensure compliance and maximizes refund recovery.

Don’t leave potential refunds on the table. Start reviewing your Canadian and Mexican import records today and ensure your claims are filed before deadlines close.

8. FAQs

Q1: Which goods qualify for IEEPA refunds under USMCA?

Generally, Canadian- or Mexican-origin goods that meet USMCA’s rules of origin and were mistakenly assessed IEEPA tariffs may qualify, as long as documentation supports their eligibility.

Q2: What are the deadlines for filing refund claims?

Refunds under Section 1520(d) typically require filing within one year of the original import date, while ACE protests often have a 180-day window from liquidation or the CBP decision date.

Q3: Do I need to file a protest or a reconciliation entry?

It depends on the nature of the error: protests challenge CBP’s assessment (e.g., duties charged in error), whereas reconciliation entries allow importers to submit final USMCA origin information after the initial entry.

Q4: What if I don’t have the Certificate of Origin for older shipments?

Without valid proof of origin, CBP is unlikely to approve a refund. Work with your suppliers as early as possible to gather any missing documentation.

Q5: Are there risks to filing incorrect refund claims?

Yes. Filing with incomplete or inaccurate information can lead to delays, penalties, or even denial of refunds. Ensure all documentation is consistent before submission.